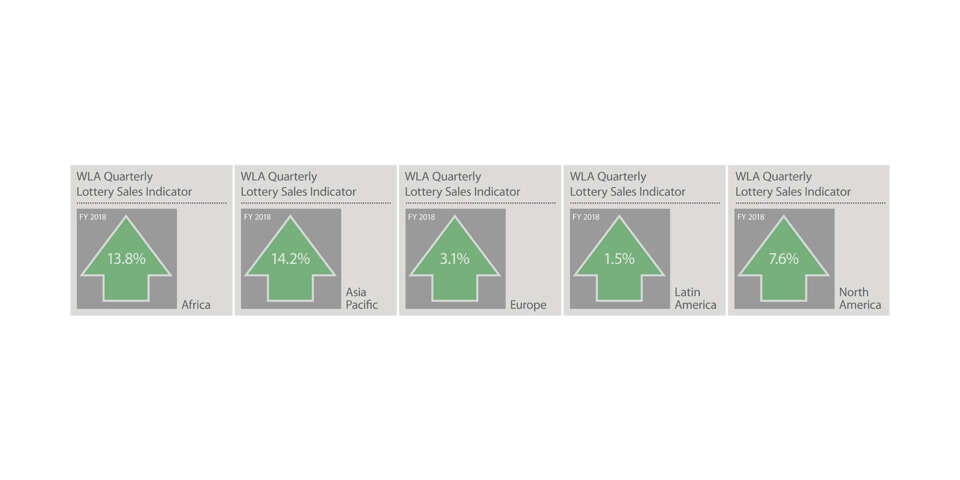

Global lottery sales for 2018 were up a healthy 8.7% on the previous year, thanks to strong second-half growth, especially in Q4 2018.

Building on mid-year results bolstered by the 2018 FIFA World Cup, Asia Pacific led the way, with a year-on-year rise in sales of 14.2%. The results from Asia Pacific just edged out contributing lotteries from Africa, which enjoyed a 13.8% increase in sales year-on-year.

It was North America’s lotteries, however, that powered ahead during the final quarter of 2018. A record-breaking Mega Millions jackpot of USD 1.6 billion pushed North American lottery sales up 15.9% in Q4. The final quarter had the effect of strapping rocket boosters onto the region’s year-on-year performance, with total sales growing 7.6% over the course of an otherwise inconsistent 2018.

Asia Pacific: China Sports Lottery powers Asia’s global performance

The China Sports Lottery’s outstanding performance over the course of 2018 powered contributing lotteries in Asia Pacific to a FY-on-FY increase in sales of 14.2% in aggregate. Collectively, sales at the mainland Chinese lotteries rose 19.9% year on year, to CNY 511.5 billion (USD 77.4 billion). The China Sports Lottery contributed 56.1%, or CNY 286.9 billion, of the approximately half-trillion yuan total, while the China Welfare Lottery contributed CNY 224.6 billion, or 43.9%.

Sales at the China Sports Lottery grew 36.8% year-on-year, on the back of stellar growth in June–July 2018. The 2018 FIFA World Cup, held 14 June–15 July 2018, saw the lottery’s Q2-on-Q2 and Q3-on-Q3 sales increase by 57% and 50.3% respectively. Sales for Q4-on-Q4 were only moderate in comparison, clocking in at 19.5%. Overall, the Sports Lottery’s sales were up an indicator-leading 36.8% year-on-year.

The Chinese Welfare Lottery had a more modest year, with FY 2018 sales up 3.5% on FY 2017. Despite the prominent role played by sports betting in the FY 2018 results for the mainland Chinese lotteries, traditional numbers games still accounted for 53.9% of all 2018 sales. Sports betting accounted for 32.3% of all sales while video lottery sales accounted for 9.3% of the total. Sales of instants and Keno contributed 4.4% and 0.1% of the total respectively.

In the special administrative region of Hong Kong, the Hong Kong Jockey Club recorded a 6.5% rise on 2017 sales. Elsewhere in Asia Pacific, Australia’s Lotterywest enjoyed a stronger year, with total sales rising 8.0% year-on-year, whereas FY-on-FY sales of Japan’s Takara-kuji lottery contracted slightly.

Africa: Morocco leads a good year for Africa

Contributing African lotteries saw aggregate sales increase by 13.8% over the 12 months to December 2018, versus the 12 months to December 2017. After China’s Sports Lottery, Morocco’s La Marocaine des Jeux (MDJS) was the indicator’s second-best performing lottery of 2018, with MDJS reporting a 23.8% increase in sales for FY 2018, as against 2017. The performance of Morocco’s sports betting flagship was one of the highlights in a strong year for Africa.

As in China, the growth in sales at MDJS was driven largely by an increase in sports betting. Sales of MDJS’ sports betting products rose 39% year-on-year.

The popularity of the 2018 FIFA World Cup accounted in part for MDJS’ outstanding performance, but was also driven by an improvement in both its hard and soft product. Live betting was introduced, more competitions were added to the offering, and better marketing campaigns were launched. The lottery also believes that its players have matured as much as the product, with punters understanding and enjoying the sports betting experience more than ever.

The success of MDJS in 2018 was reflected in the North African lottery’s decision to renew its contract with INTRALOT Group. The partnership, which was launched in 2010, was renewed for another eight years.

If MDJS was the shining star among Africa’s lotteries, its compatriot Loterie Nationale (Morocco) was not far behind, with full-year on full-year sales at the Moroccan national lottery increasing 19.9%. Growth at Loterie National was built on its first-half on first-half performance, which saw sales increase by 26.9%.

For its part, the Mauritian National Lottery could be well satisfied with an impressive final quarter of 2018. Q4 2018 sales were up by nearly 30% on Q4 2017, pushing total sales for FY 2018 up 10.4%, as against FY 2017.

A second weekly draw was added in September 2018, and has been among the biggest contributors to the lottery’s outstanding final quarter. The solid 2018 performance has helped the lottery’s recovery from a 2015 ruling that banned its Quick Win category of games.

North America: Mega Millions fuels outstanding Q4 in North America

An outstanding final quarter of the year in North America saw contributing North American lotteries offset a steadier first three-quarters. A Q4-on-Q4 aggregate increase in sales of 15.9% helped total sales for the region grow 7.6% year-on-year.

The California State Lottery led the way during the final quarter of 2018 with total sales up 28.3% to USD 459.5 million, for a full-year on full-year increase in sales of 9.4%. The lottery was able to thank a record-breaking Mega Millions sequence for the Q4 2018 windfall. The sequence began with an advertised jackpot of USD 40 million on July 27, 2018, and rolled over 25 times to a peak advertised jackpot of USD 1.6 billion on October 23, 2018. The California Lottery's sales for the entire sequence (25 rolls) were USD 357.9 million. To put this in context, this figure represents nearly 77% of the lottery’s budgeted sales revenue from Mega Millions for the entire fiscal year. More importantly, the lottery’s estimated contribution to its sole beneficiary (California public education) from the 25-roll Mega Millions sequence was more than USD 143 million.

Other state lotteries were also thankful for this bonanza, with the New York State Lottery, the Connecticut Lottery Corporation, the Kentucky Lottery Corporation, and the Tennessee Education Lottery Corporation all recording double-digit increases in sales for Q4 2018 versus Q4 2017. The Q4-on-Q4 increase in sales of 16.6% reported by the Kentucky Lottery helped propelled the southern lottery to a 4.8% full-year on full-year increase in sales. Commenting on the performance of the Kentucky Lottery, President and CEO Tom Delacenserie said, “Our strong growth (2018 vs. 2017) is due in part to an investment in ‘best practice’ execution starting with better products, stronger marketing support, improved awareness at the point of sale, and inventory levels matching growth potential – right inventory, in the right amounts, at the right time, and in the right place. Strong Powerball and Mega Millions Jackpots also contributed to our growth. These factors have led to record sales but more importantly record transfers to education in Kentucky, reinforcing our mission statement… ‘Fueling Imagination, Funding Education’”.

Canada’s lotteries also enjoyed fine final quarters with Loto-Québec leading the way with a 21.1% rise on Q4 2017. The British Columbia Lottery Corporation (BCLC), Loto-Québec, and Ontario Lottery all enjoyed growth rates of between 11% and 12% for calendar year 2018, as against calendar year 2017, with BCLC topping out at a full-year on full-year increase in sales of 11.8%.

BCLC saw strong growth in the Lotto Max, Extra games, and Scratch and Win categories. The growth of Lotto Max and Extra were fueled by higher jackpots compared to 2017 on the one hand, and by the increased reach and sales at Lotto Express terminals on the other. Lotto Express terminals are now installed at over 2,000 grocery lanes across the province.

Europe: Europe’s lotteries content with solid year

Contributing lotteries in Europe experienced a quieter 2018, with full-year on full-year sales growing by 3.1% in aggregate.

Hungary’s Szerencsejáték Zrt. was Europe’s fastest growing lottery in 2018, with total sales rising 12.5% on the previous year. It also grew 12.0% in the final quarter. Sports betting games were among the most popular products sold by the Hungarian national lottery in 2018, thanks in particular to the 2018 FIFA World Cup. Nonetheless, the biggest impact on sales came through the growth of instant tickets. The lottery’s EUR 6 Kaszinó instant ticket, launched in April 2018, proved extremely popular with locals, even becoming something of a phenomenon. The positive macro-economic environment in Hungary throughout 2018 also had an indirect effect on the demand for lottery games, with players having more disposable income.

Spain’s ONCE also had a good year with total sales up 8.5% over the course of the year.

At France’s FDJ, player stakes grew 4.4% year-on-year to EUR 15.8 billion in 2018. The operator’s long-term investment in its digital product paid off, with digital stakes in points of sale and online growing by 45.5% over the previous year.

France’s victorious campaign at the 2018 FIFA World Cup also helped FDJ to record bets during the tournament, while new lottery games were launched as part of a national campaign to support French heritage sites ('Mission Patrimoine').

Commenting on the 2018 results, Stéphane Pallez, President and CEO of FDJ said, “The continued growth in player stakes reflects the good execution of our FDJ 2020 strategy around areas such as innovation and digital, enhancing the appeal of our games and distribution channels. 2018 has been characterized by numerous successes, notably Mission Patrimoine games, illustrating FDJ’s redistribution model. These results underpin our ambition to anticipate changes in the gaming and entertainment sector to increase the Group's leadership with richer and innovative gaming experiences”.

Elsewhere in Europe, Norway’s Norsk Tipping, Poland’s Totalizator Sportowy, and the UK’s Camelot all enjoyed year-on-year growth rates of around 5%. Commenting on the year-on-year increase in sales of 4.9% at Norsk Tipping, Thorbjørn A. Unneberg, EVP Customer and Markets, remarked, “It was another strong year for Norsk Tipping, with increasing sales and GGR versus the previous year’s performance. Growth was driven primarily by solid performance in the Eurojackpot lottery, digital games (casino), and a positive performance within the sports segment. In contrast, scratch tickets (physical) and VLT’s showed somewhat declining performance year on year.” Commenting further, Mr. Unneberg said, “2018 also showed growth in numbers of players both for the lottery, sports, and digital segments, indicating that some offshore players are attracted by the Norsk Tipping product offering, contributing to an overall growth in the customer base by 3% year-on-year.”

Latin America: Polla Chilena leads the pack in Latin America

In Latin America, Chile’s Polla Chilena de Beneficencia was Latin America’s standout performer, with an excellent Q4 rounding off a successful 2018. Total sales were up 22.7% Q4-on-Q4 and 16.4% year-on-year. Again, the 2018 FIFA World Cup played an important part in Polla Chilena’s 2018 success, with results for June 2018 up 87.3% against the corresponding results of June 2017.

Mexico’s Pronósticos para la Asistencia Pública also enjoyed a good final three months of 2018 with 11.8% Q4-on-Q4 growth propelling the Mexican lottery’s growth to 9.3% year-on-year.

According to José Alfonso Pascual Solórzano Fraga, Director of Sales at Pronósticos, the operator has 14 products in its range, with five of them (Tris and four members of the Melate family) representing two-thirds of sales, and the other nine products representing the other third. The Melate family of games grew on average by 13.1% year-on-year, representing 36% of total sales. In general, the sales of all products rose in 2018, except for Tris.

While Mexico and Chile enjoyed robust growth, Brazil’s Caixa Econômica Federal had a year of peaks and troughs that levelled out over the course of the year. With total sales far outweighing any other contributing lottery in the region, Caixa’s steady 2018 had the effect of curbing Latin America’s overall growth for the year to 1.5%.

Looking forward

The WLA will continue to track the progress of global lottery sales in future editions of the WLA QLSI. Once again we thank all WLA member lotteries participating in this initiative, and look forward to bringing you the first quarter 2019 results shortly.

Luca Esposito

WLA Executive Director

*Based on sales of participating lotteries. Participating lotteries by region:

| Africa |

|---|

| Ghana: National Lottery Authority |

| Mauritius: Mauritius National Lottery |

| Morocco: La Marocaine des Jeux et des Sports |

| Morocco: Loterie Nationale |

| South Africa: Ithuba Holdings (RF) (Proprietary) Limited |

| Asia Pacific |

|---|

| Australia: LotteryWest |

| China: China Sports Lottery |

| China: Chinese Welfare Lottery |

| Hong Kong: HKJC |

| Japan: Mizuho Bank Ltd. |

| Europe |

|---|

| Czech Republic: SAZKA a.s. |

| Finland: Veikkaus Oy |

| France: Française des Jeux |

| Greece: OPAP |

| Hungary: Szerencsejáték Zrt. |

| Italy: Lottomatica S.p.A |

| Norway: Norsk Tipping AS |

| Poland: Totalizator Sportowy Sp. z o.o. |

| Spain: Loterías y Apuestas del Estado |

| Spain: Organización Nacional de Ciegos Españoles |

| Sweden: AB Svenska Spel |

| Switzerland: Loterie Romande |

| United Kingdom: Camelot UK Lotteries Limited |

| Latin America |

|---|

| Brazil: Caixa Econômica Federal |

| Chile: Polla Chilena de Beneficencia |

| Mexico: Lotería National para la Asistencia Pública |

| Mexico: Pronósticos |

| North America |

|---|

| Canada: BCLC |

| Canada: Loto-Québec |

| Canada: Ontario Lottery |

| USA: California Lottery |

| USA: Connecticut Lottery Corporation |

| USA: Florida Lottery |

| USA: Kentucky Lottery Corporation |

| USA: New York State Lottery |

| USA: Tennessee Education Lottery Corporation |

All WLA members receive the WLA Quarterly Lottery Sales Indicator. Individual sales figures are confidential, and are available only to participating lotteries. Participating lotteries receive a separate, more detailed breakdown of quarterly sales figures. For enquiries regarding participation in the WLA Quarterly Lottery Sales Indicator, please contact Dr. Matthew Spinks ([email protected]) at the WLA Basel business office.